8 Steps to Buying a Home

Let me support you during the home buying process from start to finish. Buying a home typically takes from four weeks to six months. It can be quicker if you make a firm offer right away in a fast-moving market or slower if you have a hard time finding just the right place. Transparency between you and me will also make this process quicker and swifter. If I know your exact needs I can hunt and network with better precision. Most buyers can expect to spend about six months purchasing a home. I’ve broken down the home buying process into eight steps. Each step on the home buying timeline includes a summary of the process. Following each step puts you one step closer to your goal of homeownership.

I’m telling you straight. Call me. I’m the first person to contact, and I mean this in the most humble sense. I’m your resource on all the facets and steps it takes to purchase a property, purchase your home, or sell your house. I will guide you from start to finish and be your first line of defense and support.

Jacqueline is dynamite. She brings a seasoned network to the table. Buying, selling, flipping, house hacking, investments, lots, development, syndication, joint ventures, residential construction, commercial construction — you name it — She’s ready to help!

Real estate agents help consumers by simplifying buying and selling a home. When I represent you, it means that I will put your interests above my own. In short, I use my local knowledge and experience to help you in every way possible.

With the results you can count on, I will help you understand the home buying timeline. Below is a list of services you should expect from me.

I will introduce you to my preferred financing consultant to make the financing process as painless as possible. This professional will work with you and your agent to make sure the financial aspect of your home purchase is stress-free. Servces that your consultant will help you with on the home buying timeline include:

Inform, discuss, and suggest solutions to solve any problems.

One of the first big steps to buying a home include getting your finances ready and finding the right mortgage lender. The pre-approval qualification is complementary.

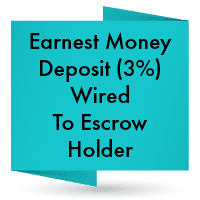

Mortgage pre-approval is the process of determining how much money you can borrow to buy a home. To receive your pre-approval letter, lenders do their due diligence in looking over your financial means which include your income, income to debt ratio, assets, credit score, and employment timeline. With this information lenders decide what loans you could be approved for, how much you can borrow, and what your interest rate might be.

Now you’ve met with your trusted advisors and you’re ready to begin your search. I will help you pinpoint homes that fit your criteria more accurately. The right home will meet all your essential needs and as many of your additional wants as possible. Some questions you might ask yourself during your journey on the home buying timeline include:

Keep in mind as you look at homes, you’ll learn that your preferences will probably adjust along the way.

It’s important to remember that a home is an investment. I can give you pertinent details on other properties in the neighborhood to help you confirm you’re making an informed decision when it comes to price. You can be sure to rely on me to explain and guide you through the offer process. When deciding on the best price we’ll consider list price, market analysis, and required improvements.

A home warranty is a contract covering repairs and replacements on systems and appliances in your home, usually for one year. A home warranty is generally paid for by the seller regardless of whether it’s a seller or buyer’s market.

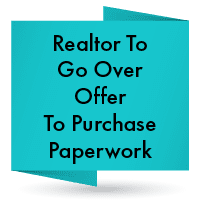

A California Residential Purchase Agreement and Joint Escrow Instructions is a legal document outlining a potential real estate transaction between two parties (seller and buyer). It’s typically used when someone wants to purchase a house or other private residence for sale. Before the deal is final, there are usually some conditions to meet. The residential purchase agreement paperwork states those conditions.

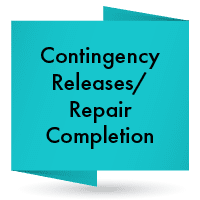

I will provide you with a list of improvements and challenges within your home while using the Home Inspection as my guide. If needed I will reach out to my professional network to help verify and clarify items on the Home Inspection report. Together we will also pay close attention to any of the seller’s disclosures. A Home and Pest Inspection and Appraisal are part of the home buying timeline, and allow for a transparent escrow. My goal is to help facilitate and understand what you are getting into before completing the purchase. While updates can increase your home value, damages can cost you. With this in mind, your primary concern is the possibility of structural damage coming from water, shifting ground, or poor construction.

A good home inspection report is extensive, containing checklists, summaries, photographs, and notes. With this intention, a home inspection aims to uncover issues with the home that even the sellers might not know about. Inspectors won’t tell you if you’re getting a good deal on the house or offer an opinion on the sale price. The inspector will check that major appliances are functional, scrutinize the heating and air-conditioning system, examine the plumbing and electrical systems, and inspect the attic and basement if accessible. A home inspection may estimate the remaining useful life of major systems and equipment as well as that of the roof and structure. The critical information will include recommended repairs and replacements, too.

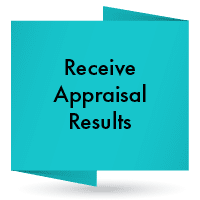

The appraiser creates a final appraisal report and offers their professional opinion on the home’s market value. In other words, they have considered the home’s condition, any upgrades or additions made to the property, the size of the lot, and “comps” or recently sold properties of comparable size and condition in the same market. The final estimation of the property’s value, based on this information — reports back to your mortgage lender.

The decision to purchase a home is one of the biggest and best choices we make in our lifetime. What’s more, the benefits of investing in a home include appreciation, home equity, tax deductions, and deductible expenses.

Simplify the home buying process — Jacqueline (REALTOR® license #02115987) is happy to interview for the job as your Realtor. Looking forward to supporting you in your real estate endeavors is at the heart of my business.

Jacqueline: 408.612.5969

110 N 3rd St #20

San Jose CA 95112

License #02115987

117 Bernal Rd Suite 70-638

San Jose, CA 95119

License #01415279

Notifications